Here’s something that’s positive to consider whether or not you’re in debt—well, the angle is positive, anyway: approximately 8 out of 10 Americans are in debt.

What that means is, if you’ve got $1 to your name, and you’re not in debt, technically you have more financial worth than most the people you know. Conversely, if you’re in that majority, you’re not some irresponsible outlier—you are the status quo.

Here’s some more bittersweet news: the average American family owes approximately $8,377 in debt. That’s a lot, but it’s not a lot. You could sell your mortgage or look into a mortgage refinance, pay off the debt, and enter into a new mortgage elsewhere once you’re debt free—that’s one strategy. The debt is bitter, but what is sweet is that a little elbow grease and determination can make you free.

As you consider getting a more tight reign on your finances, one of your first steps should be to design a budget within which you can most comfortably function.

Look at your monthly income. Are you a single breadwinner, or is there more than one breadwinner in the house? What is the monthly budget you’re working with?

https://pixabay.com/en/money-home-coin-investment-2724237/

A Prospective Budget/Payback Scheme

Say you’re in a household that pulls in $2k/month after taxes. That’s $24k a year—right at the poverty level. If you’ve got a $500 monthly mortgage, $200 in smartphone bills, $100 in internet, and $100 in other utilities, you’re looking at $900 a month. If petrol costs you $200 a month, you’re looking at $1,100. If food is $300, you’re looking at $1,400 in recurring expenses.

Throw $100 in there for unexpected situations, and you’ve got $500 free to pay off your debt monthly. In a year’s time, you can knock $6,000 off a sum of $8,377 before interest.

Factor in your interest, and it’s reasonable to expect you’ll have your debt repaid inside two years, and that with a few non-paid months fighting off emergency.

If you want to pay the debt off quicker, look at pressure points in your budget. $300 a month for food is $75 a week, or $10.71 a day. You can get that under $5 if you shop locally, prepare meals at home, and avoid snack machines as well as the junk food at convenience stores. That’s an extra $1,800 a year.

How about driving—do you really need to spend $200 a month on gas? How about riding your bike to work, walking, or taking some form of public transportation?

Or you could carpool; you drive one day, a coworker drives other days—both of you cut your transit expenses in half.

Freedom And Consolidation

https://pixabay.com/en/credit-squeeze-taxation-purse-tax-522549/

If you can cut your gas expenses in half, there’s another $1,200—now you’ve saved $9,000 against your $8,377 loan. Depending on your interest, you could have it paid off in a year. Once you have done so, then it’s time to renegotiate your mortgage—or whatever living expense you have—and get that cost so that it will attain you greater independence more quickly.

Still, this is an ideal situation. Many in debt have multiple areas they must pay into regularly, and diverse interest rates. Sometimes credit card consolidation or consolidation of loans into a single payment is the best option.

If you’re in need of a small loan, according to Swoosh.com.au, “No matter the reason, we’re here to help. Whether it’s unexpected bills or to enjoy all life has to offer, we’ll help you get the money you need—with no nasty surprises.”

You could take out a loan of this kind, pay off all your debt, and then just be required to pay back the loan at a decreased interest rate, ultimately saving you hundreds—or thousands—over time.

There are many ways to get financially independent. At the bare minimum, you need to tighten your belt and find the strategy that works best for you and those who may depend on you. Do that and you’ll see the financial independence you seek.

Hey Erik!

Good topic to talk about. People tend to not care so much about their finances and are okay with living paycheck to paycheck.

I agree with you, you do need some sort of strategy and a budget, to have your finances in order and in a good state.

I’m a bit surprised looking at the statistics you are sharing here.

Thanks for sharing!

Cheers! 😀

Hello Erik,

Good tips over here 🙂

Indeed managing our finances is one of the toughest task to deal with. The stats which you showed up here about the average

family who are in debts are scary. It do need management to deal with our finances and expenses.

Here in India too people are buried into the load of debts and other finance issues. The load of expenses is getting higher

day by day.

Thanks for the share.

Shantanu.

>What that means is, if you’ve got $1 to your name, and you’re not in debt, technically you have more financial worth than most the people you know.

Hey, that’s me! Winning! Haha.

Jokes aside, having no debt is a good start, but it’s important to start building up savings if for no other reason than to have a safety net/emergency fund, and a lot of the tips you posted here can help with just that! Don’t think that just because you’ve paid off your debts that now you have free reign to spend up all your money every month on nonsense.

Thank you !!

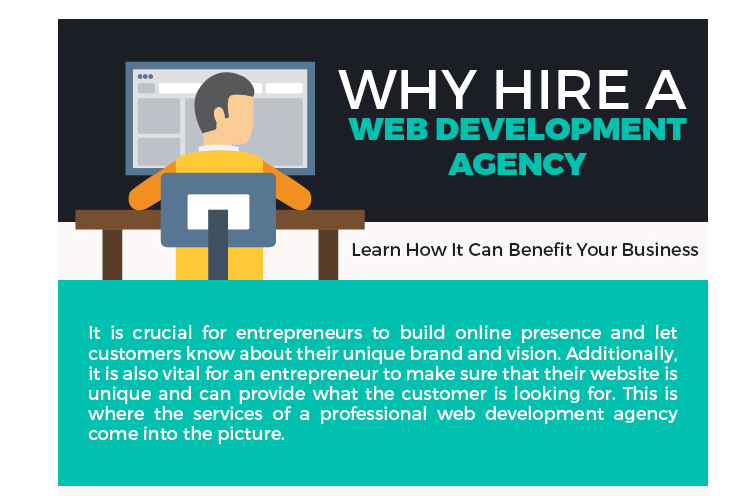

You shared very valueable information.

Hopefully it will help me leverage my business to next level.

Hi Erik,

It’s great to read your post. I was busy with my projects, that’s the reason I was inactive a bit, specially reading & commenting was completely off.

But Anyways, Thanks for the interesting read. Keep up the good work and enjoy the holidays.

A Very Happy New Year Erik! Cheers

~ Donna

Here in India too people are buried into the load of debts and other finance issues. The load of expenses is getting higher