Proprietary trading, also known as prop trading, refers to the practice of financial institutions, such as investment banks and hedge funds, using their capital to trade in various financial markets. This is different from traditional trading where institutions use client money for their trades.

In recent years, prop trading has gained popularity among individual traders looking for high-risk, high-reward opportunities. However, prop trading can be a challenging and competitive industry to break into.

In this article, we will delve into the world of prop trading and discuss the top 10 firms that aspiring traders can consider joining.

Table of Contents

Understanding Prop Trading Firms

Prop trading firms are companies that specialize in conducting proprietary trading on behalf of their clients. These firms often have a team of experienced traders who use the company’s capital to make trades in various financial markets, such as stocks, currencies, and derivatives.

Prop trading firms can be classified into two main categories: buy-side and sell-side. Buy-side prop trading firms focus on buying securities for their clients’ portfolios, while sell-side firms specialize in selling securities for their clients.

Benefits of Joining a Prop Trading Firm

There are several benefits to joining a prop trading firm, including:

- Access to capital: Unlike traditional trading where traders use their own money, prop trading firms provide access to significant amounts of capital for their traders. This allows them to take on larger positions and potentially generate higher profits.

- Professional training and support: Prop trading firms often have experienced traders who can provide mentorship and guidance to aspiring traders. This can be invaluable for those looking to learn and improve their trading skills.

- Advanced technology: Prop trading firms typically have access to advanced trading technologies, such as high-speed internet connections and sophisticated trading platforms. This can give traders a competitive edge in executing their trades.

The Top 10 Prop Trading Firms for Aspiring Traders

There are numerous prop trading firms in the market, with FTMO and The Funded Trader being in the top positions.

- FTMO: Founded in 2015, FTMO is a leading prop trading firm that offers traders the opportunity to trade with their capital. They have a comprehensive evaluation process and provide traders with valuable educational resources.

- The Funded Trader: The Funded Trader is another popular prop trading firm that offers traders access to significant amounts of capital. Their evaluation process allows traders to showcase their skills and earn a funded trading account.

- Apex Trader: With a focus on forex trading, Apex Trader provides traders with access to advanced trading tools and educational resources. They also have a unique evaluation process for aspiring traders.

- The5ers: The5ers is known for its comprehensive evaluation process that helps identify skilled and disciplined traders. They provide their traders with up to $2 million in buying power and a 50% profit share.

- Top One Trader: Established in 2012, Top One Trader offers traders access to a wide range of markets, including stocks, forex, and futures. They also have a unique risk management system and provide traders with professional support.

- FX2 Funding: FX2 Funding specializes in providing capital to experienced traders who are looking to take their trading to the next level. They offer traders up to $250,000 in buying power and a 50% profit share.

- Trade The Pool: Trade The Pool is a prop trading firm that focuses on risk management and providing traders with a supportive community. They also have an extensive education program for aspiring traders.

- FXIFY: With a strong emphasis on risk management, FXIFY offers traders access to significant amounts of capital and the ability to trade multiple markets. They also provide traders with professional support and personalized coaching.

- Tradiac: Tradiac is a prop trading firm that focuses on forex trading and offers traders access to advanced trading tools and educational resources. They have a unique evaluation process that helps identify talented traders.

- FundedNext: Founded in 2015, FundedNext offers traders the opportunity to earn a funded trading account by showcasing their skills and discipline in their evaluation process.

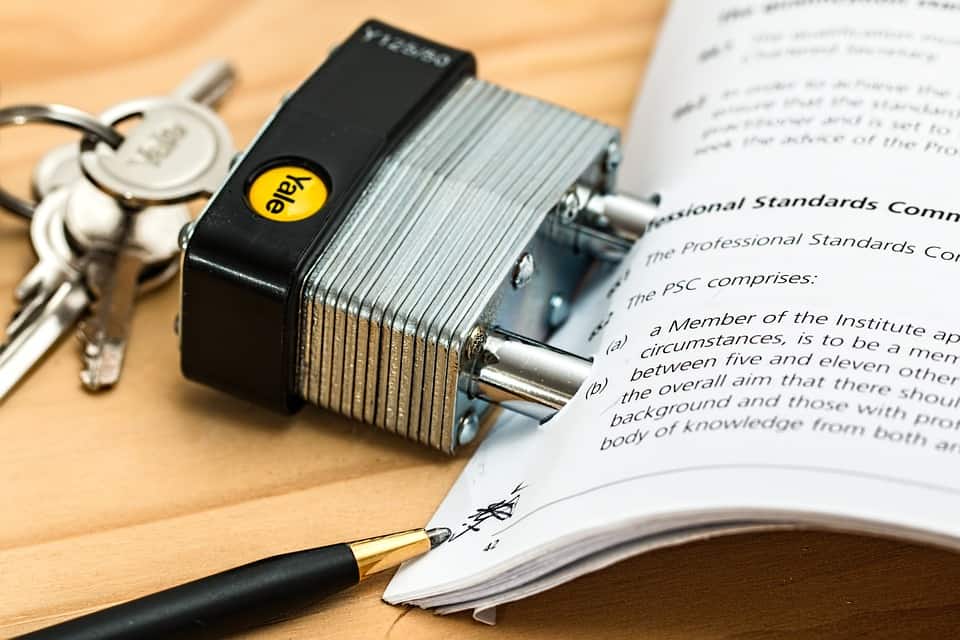

Criteria for Choosing a Prop Trading Firm

When considering joining a prop trading firm, it is essential to evaluate them based on certain criteria, such as:

- Evaluation process: Look for firms with a comprehensive and transparent evaluation process that helps identify skilled traders.

- Funding options: Consider firms that offer different funding options and levels to suit your trading style and goals.

- Education and support: Choose firms that provide professional training, mentorship, and support to help you improve as a trader.

- Risk management: Make sure the firm has sound risk management practices in place to protect your capital and profits.

Conclusion

Prop trading offers aspiring traders an exciting opportunity to trade with significant amounts of capital and access advanced technologies and support. However, it is essential to carefully evaluate and choose the right prop trading firm based on your goals, skills, and preferences. Consider joining one of the top 10 firms mentioned in this article or use the criteria provided to find the best fit for you.