When it comes to real estate investing, choosing the right platform can make all the difference. This decision can determine the ease of portfolio management, the diversity of investment options, and ultimately, your return on investment. But with an array of platforms at our fingertips, identifying the best one for your individual investment needs can be a daunting task. This document aims to guide you through the key considerations and features to look for when choosing a platform for your real estate investments.

Table of Contents

Key Considerations for Choosing a Real Estate Investment Platform

1. Investment Strategy and Risk Tolerance

The first step in choosing the best platform for your real estate investments is to assess your investment strategy and risk tolerance. Some platforms specialize in crowdfunding, where multiple investors pool their funds to invest in a specific property or project. Other platforms offer direct investing options, where you have full control over which properties you invest in. Understanding your investment goals and risk tolerance will help you narrow down the platforms that align with your needs.

2. Type and Location of Properties

Another important consideration when choosing a real estate investment platform is the type and location of properties available for investment. Some platforms focus on residential properties, while others specialize in commercial or industrial properties. Additionally, the location of the properties can vary greatly, from local to international options. It is essential to research and understand the types of properties available on each platform to ensure they align with your investment goals.

3. Fees and Costs

Fees and costs associated with using a real estate investment platform can significantly impact your return on investment. Some platforms charge fixed transaction fees, while others may take a percentage of your profits. It is crucial to compare the fees and costs across different platforms and factor them into your investment strategy.

4. Transparency and Communication

Transparency and communication are essential factors in any investment venture, including real estate investing. Look for platforms that provide regular updates on property performance, communicate any potential risks, and have a clear understanding of their fee structure. It is also beneficial to choose a platform with accessible customer service to address any questions or concerns promptly.

5. Platform Security

With any online platform, security is always a top priority. When it comes to real estate investing, make sure the platform you choose has robust security measures in place, such as encryption technology and multi-factor authentication. Additionally, research the platform’s history of any security breaches or fraud incidents to ensure your investments are safe.

6. Historical Performance

Before committing to a real estate investment platform, it is crucial to research its historical performance. Look at the average return on investment for past projects and compare them to industry standards and other platforms. This information will give you an idea of the platform’s track record and potential for success in the future.

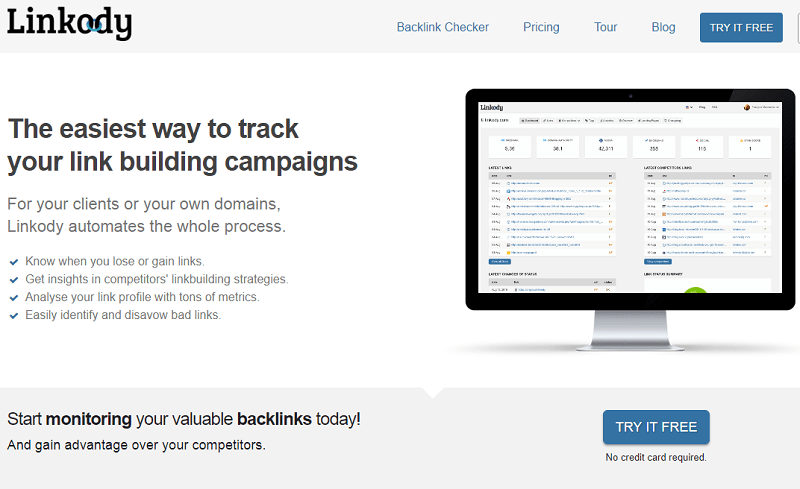

7. User-Friendly Interface

Real estate investing can be complex, so it is essential to choose a platform with a user-friendly interface. A well-designed platform should make it easy to navigate through different investment options, access property information, and track your portfolio’s performance. It should also provide educational resources for new investors to learn more about the industry and investment strategies.

Best Platforms for Real Estate Investing

- Fundrise

- Crowdstreet

- Roofstock

- RealtyMogul

- EquityMultiple

These are just a few examples of reputable and highly rated real estate investment platforms. It is crucial to research each platform’s unique features, fees, and historical performance before making a decision. Remember that the best platform for you may vary based on your individual investment needs and goals.

You can check online articles like this Fundrise vs Crowdstreet review to compare different platforms and get a better understanding of what each has to offer.

Conclusion

In conclusion, choosing the best platform for real estate investing requires careful consideration of your investment strategy, risk tolerance, property types and locations, fees, transparency and communication, security measures, historical performance, and user interface. By thoroughly researching these factors and comparing different platforms’ features, you can make an informed decision that aligns with your investment goals and sets you up for success in the world of real estate investing. So, take your time, do your research, and choose a platform that best suits your individual needs.