Financial management software refers to a range of digital tools that help individuals and businesses manage their financial activities. These activities include budgeting, invoicing, tracking expenses and income, tax preparation, and creating financial reports. With the advent of technology, traditional methods of financial management are being replaced by more efficient and accurate software solutions.

In this document, we will discuss the various benefits of using financial management software to manage your finances. These benefits range from real-time access to financial data, automation of financial tasks, enhanced accuracy and reduction of errors, easy integration with other business systems, comprehensive financial reporting and analysis, improved decision-making, cost savings, improved compliance and security, efficient cash flow management, and scaling capability for growing businesses.

Table of Contents

Benefit 1: Real-time Access to Financial Data

One of the main benefits of using financial management software is the ability to access real-time financial data. With traditional methods, it could take hours or even days to gather and consolidate financial information from different sources. However, with financial management software, you can get an instant overview of your finances at any given moment. This real-time access to data allows for better decision-making and enables individuals and businesses to stay on top of their financial health.

Benefit 2: Automation of Financial Tasks

Another significant benefit of using financial management software is the automation of financial tasks. With manual methods, tasks like creating invoices, tracking payments and expenses, and preparing taxes can be time-consuming and prone to errors. Financial management software automates these tasks, saving time and reducing the risk of human error. This automation also allows for better organization and streamlining of financial processes.

Benefit 3: Enhanced Accuracy and Reduction of Errors

Financial management software minimizes the chances of human error in financial tasks. With automated calculations and data entry, there is a higher level of accuracy compared to manual methods. This accuracy is crucial, especially when dealing with complex financial data. With fewer errors, individuals and businesses can have confidence in the reliability of their financial records.

Benefit 4: Easy Integration with Other Business Systems

Financial management software offers easy integration with other business systems such as accounting, payroll, and inventory management. This integration allows for seamless communication between different departments, streamlining financial processes and improving efficiency. It also eliminates the need for manual data entry, reducing the risk of errors and saving time.

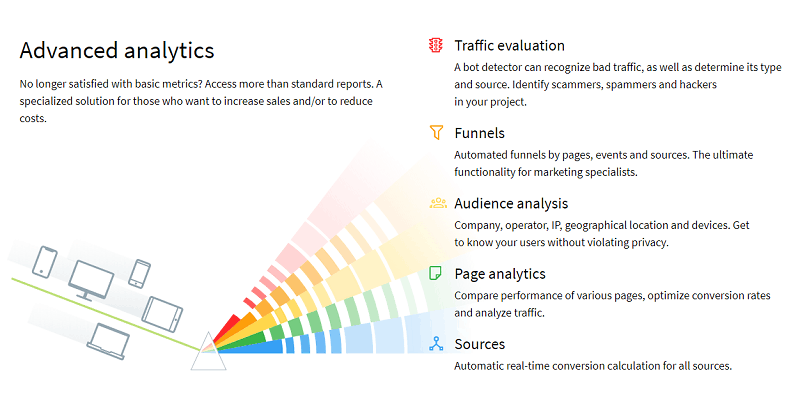

Benefit 5: Comprehensive Financial Reporting and Analysis

One of the essential features of financial management software is its ability to generate comprehensive financial reports and perform in-depth analyses. These reports provide individuals and businesses with a detailed overview of their financial performance, allowing for better decision-making. With analysis tools, it is also possible to identify trends and patterns in financial data, enabling individuals and businesses to make strategic decisions.

Benefit 6: Improved Decision Making

Financial management software provides individuals and businesses with real-time access to their financial data, automation of tasks, enhanced accuracy, and comprehensive reporting. These features allow for better decision-making, as decisions can be based on accurate and up-to-date data. With the ability to analyze financial data, individuals and businesses can make informed decisions that will benefit their financial health in the long run.

Benefit 7: Cost Savings

Using financial management software can result in cost savings for individuals and businesses. With automated processes, there is a reduction in manual labor, which can save time and money. The accuracy of the software also reduces the risk of financial errors that could result in costly consequences. Additionally, with improved decision-making, individuals and businesses can avoid unnecessary expenses and make more financially beneficial choices.

Benefit 8: Improved Compliance and Security

Financial management software offers features that ensure compliance with financial regulations and security protocols. The software can generate reports and documents that meet regulatory requirements, making it easier for individuals and businesses to stay compliant. Furthermore, with secure data storage and encrypted communication, financial management software provides a safe environment for sensitive financial information.

Benefit 9: Efficient Cash Flow Management

Efficient cash flow management is crucial for the success of any business. Financial management software allows individuals and businesses to track their cash flow in real time, making it easier to manage expenses and income. With accurate data and analysis tools, individuals and businesses can make financial decisions that will improve their cash flow and overall financial health.

Benefit 10: Scaling Capability for Growing Businesses

As a business grows, its financial management needs become more complex. Financial management software offers features that can scale to accommodate the increasing demands of a growing business. With automation, accuracy, and comprehensive reporting, this software can support businesses as they expand, making it easier to manage finances and make strategic decisions for future growth.

Final Words

In conclusion, financial management software offers numerous benefits that can help individuals and businesses efficiently manage their finances. From real-time access to data, automation of tasks, enhanced accuracy, and comprehensive reporting to improved decision-making, cost savings, compliance and security, efficient cash flow management, and scaling capability for growing businesses. Investing in financial management software can greatly improve the financial health of individuals and businesses, leading to success and growth in the long run. So, it is a wise choice to make use of this technology for managing finances effectively.