Some people are very budget-conscious, while others are not. Some people pay very close attention to benefits that they may be entitled to, whereas for other people, this is not so much of a focus.

However, if you can figure out how to mix those two ideas, then you will give yourself an excellent chance to feel comfortable with the synergy between the two concepts.

Several specific examples illustrate this relationship.

First, the benefits that come with Social Security disability have a lot to do with how much money you can spend each month.

Second, when you begin looking into healthcare benefits, you’ll see that the amount of money that you have allocated each month has a direct reflection on your ability to purchase goods and services that relate to your health and wellness.

And third, if you pay attention to the benefits that come from job stability, you’ll note how much those benefits play into your concept of income.

Table of Contents

Social Security Disability

When it’s time to apply for SSD benefits, you may be a little uncertain of the process. Lucky for you, you can call an SSD lawyer who will give you all the necessary information. Many people have their initial claims denied not because they don’t deserve the benefits, but rather because they don’t know how to apply for them appropriately.

Plus, if you are denied benefits and you feel like this denial is not appropriate or even illegal, an attorney can be the one to fight for you.

Health Care Benefits

How much money do you budget per month for your health and wellness? Signing up for healthcare, you probably pay a specific premium every month. But what does this premium get you?

You have to consider that when putting your budget together each month. There are still deductibles, co-pays, and other factors to include when you’re deciding what portion of your monthly income goes into this category.

Job Stability

One of the great things about having a stable job is that they often come with benefits. The longer you keep a job and the more responsible you are, the more likely your company is to include these additions to your income along with your monthly check. When you are applying for jobs initially, be sure to check what benefits they may have.

If the benefits available will replace some of the bills that you have monthly, then you can expand your budget to include this adjusted income level.

If you’re trying to figure out where your benefits fit into your budget each month, it’s very important that you understand what those benefits are and what their monetary value is. With this information, your financial planning will be much better.

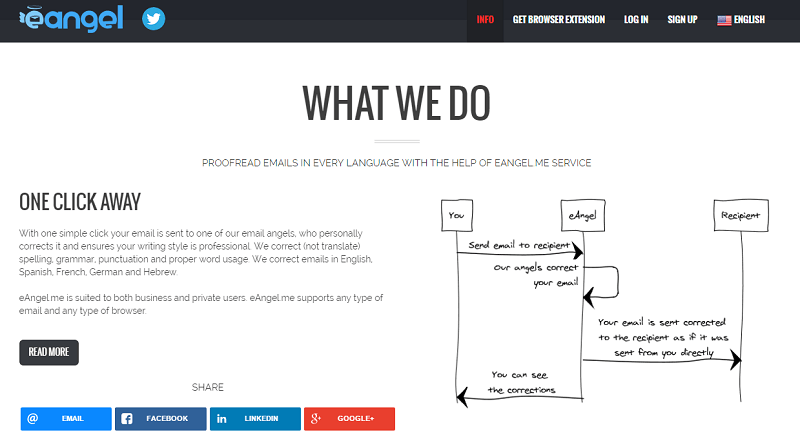

Erik,

Quite a useful topic. I find these ideas more distinct and I never thought of these in your perspective. As I not much familiar with these, I have read the content twice for better understanding. Thanks for educating us on something beyond web designing and marketing.