If you imagine yourself on a beach, sipping a glass of something cold and bubbly once you reach retirement age, you probably need to start thinking about your financial future right now. In particular, those that really want to lay down some good foundations need to consider investing their money to get the maximum return.

Luckily the guide below will help you do that. So keep reading to see where you should make your investments for a sound financial future.

Table of Contents

Peer to Peer Lending

Peer to peer lending is a relatively new strategy on the scene. It entails putting up money for others to borrow. Usually as a small business loan.

It’s a medium risk investment, meaning that while you may not get back a huge increase of what you pay out, you are less likely to lose the whole thing as well. Making it a good choice for folks that are more nervous about investing and want to try their toe in the water.

You also have the added benefit of knowing that you are doing something constructive with your money, and helping a fledgling business get off of the ground. Something that can make this an appealing choice for many.

Savings

While savings are often not counted as an investment, they can still provide a return on your money, if you do it right. To be successful, it’s pretty important that you understand the difference between the various savings accounts out there and leverage these to your advantage.

For example, there are instant savers accounts that allow you access to your money whenever you need it. However, these usually don’t have a good rate of interest, meaning they are not the best use of your money for the long term.

Better are ISAs, as they usually have a higher rate of interest. Although they are governed by certain rules and regulations. Meaning you can only put in up to a certain amount per year. Some also have caps of what you can withdraw and whether you can top this up later on or not. So it is worth familiarizing yourself with these before you invest.

Insurance

Life Insurance is another thing that is often seen as separate to investments but actually, works in the same way. As you are paying in money to have a safety plan for the future after all. The idea being that you pick a policy that you pay into monthly. This will then pay out, depending on the term of your contract if you get ill, are incapacitated and cannot make bill payments, or to your family if you pass.

Granted it’s not always the easiest thing to think about, and no one likes to talk about the worst-case scenario. However, it only takes a small amount of time to get sorted, and a small monthly investment gives you the peace of mind that if anything did happen your debts and family would be taken care of.

Property

Investing in property is definitely something you should think about if you want to prepare for your financial future now. In fact, many people prefer this sort of investment to that of stock or bonds because they are putting their money in something real and physical like a house or apartment. That is something that can provide them security even if the market does crash because they will still have a tangible place, that they can live in if they choose.

Of course, there are lots of different ways to invest in property to consider, each with their own risk levels. Flipping is one such strategy. This is when you buy a property in need of renovation work, do that work and then sell it on for a profit. Usually, in the shortest amount of time possible.

It sounds easy, but like anything worth doing it really isn’t. Mainly because there is such a mix of project management, financial, and practical skills involved. After all, first you have to find a suitable property, considering location, condition and price. Then you have to renovate it to a sellable condition. Something that you may do parts of yourself, and then have to coordinate with professionals for the rest, for things like electrical work or plumbing that needs completing.

In particular, the renovation side of things can often take longer, and be more expensive than first expected. Something that can eat into your expected profit from the sale at the end. It is this, as well as the fact that you have to put a fair bit of money in to see a return that makes this sort of investment a medium to high risk. Meaning you should consider it carefully before investing.

Property Abroad

Another option for property investment is buying a place overseas. These properties can be flipped and sold, but it’s often harder to do that because of the geographical distance. So it makes more sense to purchase one that is already in good condition and then rent it out, either as a residential concern or a vacation home depending on the location.

Regarding locations, classic holidays areas are a good choice, as are large cities. As there will always be a need for rental properties in these areas, making it more likely you will get a consistent income from your investment.

Of course, you won’t be able to deal with the day to day running of the property yourself, but luckily there are property management companies like HDB rental out there, that can market it for you. Making this sort of overseas investment a little easier to deal with.

In terms of risk, buying a property to rent is usually a lower risk than flipping because the idea is that the rental income pays for the mortgage. Then, once the mortgage is paid off, you will own the entire thing, leaving you free to sell it and use the profit you make in whatever way you see fit.

Stocks

Stocks and shares are probably the best-known type of financial investment to make. Although surprising, not everyone understands what they entail.

You buy a share of the company, usually multiple ones. This then gives the company an injection of cash that they can choose to do with, what they will.

It also gives you a say in the way the company’s run, the more shares you have giving you a larger majority. Something that can be used when decisions are voted on.

However, most investors don’t use them in this way. Instead, they buy and trade them on the stock market, something that is always in a state of flux. The idea is that you should buy for a low price and sell for a higher price, and that is where you make your profit.

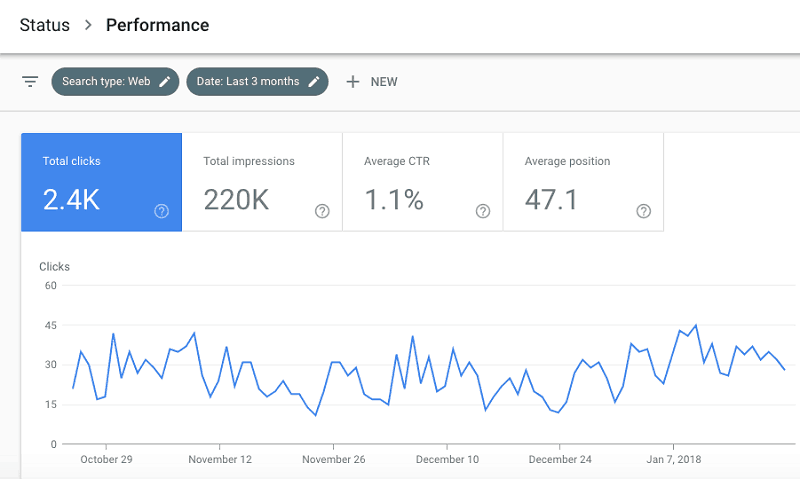

Of course, depending on the type of stocks and shares you end up investing in this can be a pretty high-risk venture. Especially, if the market is unstable or you are looking to make a good profit in a short space of time.

Using a day trading platform can be a good way of managing your investments. It will allow you to keep on top of the stock market and make sure that you are not taking too much risk or missing any potential opportunities.

It is also worth noting that there are different types of stocks and shares, such as preferred stocks, common stocks, bonds and more. Each one comes with its own set of risks and rewards that will need to be considered before making any decisions.

It is also important to remember that stock market investments, regardless of what type you decide on are always subject to the fluctuations of the stock market. The current state of the global economy can have a huge impact on how much money you make or lose when investing in stocks and shares. Therefore, it is a good idea to keep your finger on the pulse of the stock markets and be aware of any potential changes.

In fact, many financial advisers suggest that you can lower the risk of investing in stocks and shares by choosing investments over the long term. This is because they argue that the market roughly increases over a 9 year period or longer. 9 years being the minimum time to maintain your investment. So if you can keep your money in for that long, you are more likely to see a profit, rather than a loss.

Stocks is risky, better invest in real estate.

These are all good options, it all depends on your level of exposure, training…

I for one will prefer property as number one then others follow.

Keep up the good work.