Short-term loans that use the title for your vehicle as collateral are common, and with good reason.

These title loans work very simply because the loan company uses the value of your vehicle to give you the loan and they place a lien on the title until the loan is paid back.

They are great for emergencies and unexpected expenses, and there are many advantages to them compared to other types of loans. Below are a few of those reasons.

Table of Contents

1. They Are Cheaper Than Cash Advances

Because you use the title of your vehicle as collateral, these are not unsecured loans; therefore, the annual percentage rate tends to be lower than other types comparable loans, including cash advances.

Although it may seem as if cash advances are a great idea, they often come with interest rates and fees that are much higher than a loan based on your car’s title.

2. You Do Not Need to Worry About Your Credit Score

Secured loans usually come without the need for a strong credit score, and this includes title loans. This means that even if your credit score is low, it is still possible to get one of these loans.

In fact, if you have a clear title and a steady income, that is usually all you need to qualify for the money. A certain credit score is simply not needed.

3. They Eliminate Stress

If you need a small amount of cash for unexpected car repairs or to help with other bills, a loan based on your vehicle’s title can be relied on.

This means that unexpected expenses no longer need to cause you stress because you’ll always have a way to take care of them.

With a clear vehicle title and a job, you’ll always know that you can handle expenses that come out of the blue.

4. They Are a Fast Way to Get the Money That You Need

Unlike standard bank loans, title loans are usually completed quickly and can often provide you with your much-needed money in as little as 20 minutes.

There is no need to wait for a week or more for the money to be transferred into your account because these loans are usually virtually instantaneous. This makes it especially useful when unexpected financial needs arise.

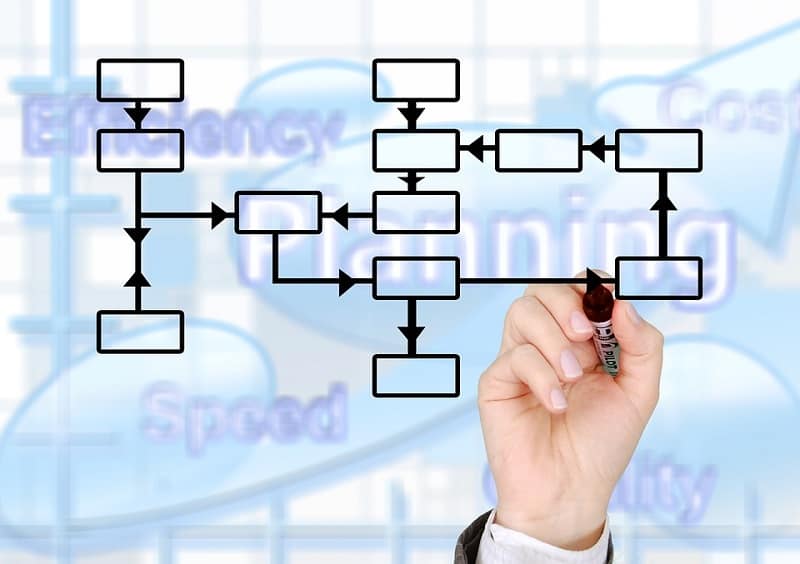

5. They Don’t Require a Mountain of Paperwork

Bank and other loans often require a lot of paperwork, but such is not the case if you are using your car as collateral.

Usually, the only documents that you need are your driver’s license, proof of income, proof of residency, and, of course, your title. There is usually nothing else required to get your loan.

6. You Can Keep Driving Your Car

One of the biggest advantages of choosing title loans is that you get to keep your vehicle the entire time. There is no need to turn over your vehicle to the loan company while you figure out how to pay back the money.

Remember that they will have the title until you pay the loan back so you can continue to drive your vehicle even before you do so.

Hello Erik,

Almost in everyone life, there is always a time when require raising money fast.

Most important thing which I like about title loans – They come in handy because they are often approved on the same day you apply and do not take into account factors like your credit score.

Ease of access is one of the advantages that make title loans popular. Eventually, thanks for adding much valuable facts regarding this topic.

With best wishes,

Amar Kumar