Financial health is the backbone of any successful business, and for small businesses, it is crucial to ensure long-term sustainability and growth. Entrepreneurs often face the challenge of managing limited resources while striving to maintain financial stability. However, with careful planning and the right strategies, small businesses can easily improve their financial health.

This article provides nine useful tips to help entrepreneurs navigate the complexities of business finances and secure a prosperous future.

Table of Contents

1. Track and Monitor Cash Flow Regularly

Cash flow management is one of the most critical aspects of financial health. It involves keeping a close eye on the money coming into and going out of your business. Regular monitoring of cash flow ensures that you are always aware of your financial position and can make informed decisions.

To track cash flow effectively, consider using financial software or tools that can automate the process and provide real-time insights. Regularly review your income and expenses, and ensure that you have enough liquidity to cover your operating costs. This practice will help you avoid cash shortages and ensure that your business remains financially stable.

2. Hire a Qualified Finance Manager

Having a finance expert on your team is essential for maintaining financial health. A finance manager with at least a bachelor’s degree in finance can bring valuable expertise to your business, helping you manage your finances more effectively and make informed decisions.

However, if hiring a finance manager is not feasible due to limited capital or resources, consider pursuing a finance bachelor degree online yourself. It will equip you with the necessary knowledge to manage your business finances. Moreover, you can encourage growth within your organization by providing financial training to employees who show potential.

3. Separate Personal and Business Finances

One of the most common mistakes small business owners make is mixing personal and business finances. This practice can lead to confusion, inaccurate financial reporting, and potential legal issues. Hence, to prevent any mishaps, make sure you draw a visible line between personal money and business finances.

Start by opening a separate business bank account and using it exclusively for business transactions. This will make it easier to track your business expenses and income, file taxes accurately, and maintain a clear financial picture of your business. By keeping your finances separate, you’ll also protect your personal assets from business liabilities, which is especially important if your business faces legal challenges.

4. Create a Realistic Budget

A well-planned budget is a roadmap to financial stability. It helps you allocate resources efficiently, control spending, and plan for the future. Creating a realistic budget that aligns with your business goals is essential for maintaining financial health.

When creating your budget, consider both your current needs and future aspirations. Include all your fixed and variable expenses, and ensure that your budget is flexible enough to accommodate unexpected costs. Regularly revisit and adjust your budget to reflect changes in your business environment. By doing so, you can avoid overspending, stay on track with your financial goals, and ensure that your business remains profitable.

5. Manage Debt Wisely

While debt can provide the capital needed for growth, it can also become a burden if not managed wisely.

Prioritize your debt payments by focusing on high-interest debts first, as these can quickly spiral out of control if left unattended. Avoid taking on unnecessary debt and consider refinancing or consolidating existing debts to reduce interest rates and monthly payments. By managing your debt responsibly, you can free up resources to invest in other areas of your business and ensure long-term financial stability.

6. Build an Emergency Fund

An emergency fund is a financial safety net that every small business should have. It serves as a buffer for unexpected expenses or downturns in revenue, ensuring that your business can continue operating even during challenging times.

To start building your emergency fund, allocate a portion of your profits each month into a separate savings account specifically designated for emergencies. Ideally, this fund should cover at least three to six months of operating expenses. Even if your business has limited resources, regularly contributing small amounts can help build a substantial emergency fund over time. This financial cushion will protect your business from unforeseen events and allow you to focus on growth and development without constantly worrying about potential financial crises.

7. Optimize Tax Strategies

Understanding your tax obligations and finding ways to minimize your tax liability is essential to maximize profits and ensure compliance with tax laws.

Working with a tax professional is one of the best ways to optimize your tax strategies. They can help you identify deductions, credits, and other tax-saving opportunities that you may not be aware of. Proper tax planning can also help you avoid penalties and ensure that you are fully compliant with all tax regulations. Regularly review your tax situation and adjust your strategies as needed to ensure that your business is taking advantage of all available tax benefits.

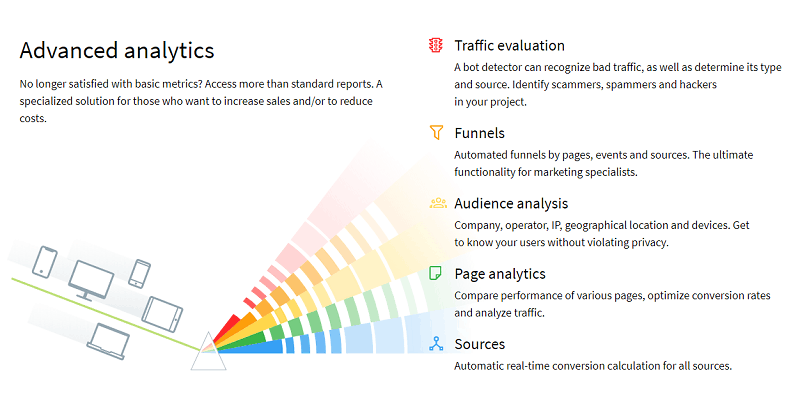

8. Invest in Financial Management Tools

Technology has revolutionized the way businesses manage their finances. Investing in financial management tools can streamline your financial processes, improve accuracy, and save time. These tools can provide valuable insights into your business’s financial health, helping you make more informed decisions.

There are various financial management tools available, ranging from basic accounting software to comprehensive financial planning platforms. Choose tools that fit your specific business needs and budget. For example, accounting software like QuickBooks or Xero can help you manage your books, track expenses, and generate financial reports. More advanced tools may offer features like cash flow forecasting, budgeting, and financial analytics. By leveraging these tools, you can gain better control over your finances and focus more on growing your business.

9. Review and Adjust Pricing Strategies

Pricing is a critical factor in determining your business’s profitability. Regularly reviewing and adjusting your pricing strategies is vital to ensure that your products or services are competitively priced while still generating sufficient profit margins.

To review your pricing strategies, start by analyzing your costs, market trends, and competitor pricing. Ensure that your prices cover all costs, including production, marketing, and overheads, while providing a reasonable profit margin. It’s also important to consider the value your products or services offer to customers. If necessary, adjust your pricing to reflect changes in costs or market conditions. Periodically reviewing and fine-tuning your pricing strategies will help you stay competitive and maintain profitability in a dynamic business environment.

Write Your Financial Destiny

A small business’s financial health is nothing less than the pulse of your entire operation. Strong financial practices empower you to seize opportunities, weather economic storms, and ultimately build a resilient enterprise that can grow and adapt in an ever-changing market. By focusing on sound financial strategies, you’re not just safeguarding your business’s present—you’re investing in its future. Take control of your financial destiny, and watch your business flourish.