Personal loans can be a crucial lifeline for small business owners, providing much-needed funds to manage various expenses. However, without proper management, these loans can quickly become overwhelming. Discover effective finance techniques to keep your loan payments under control and ensure your business thrives.

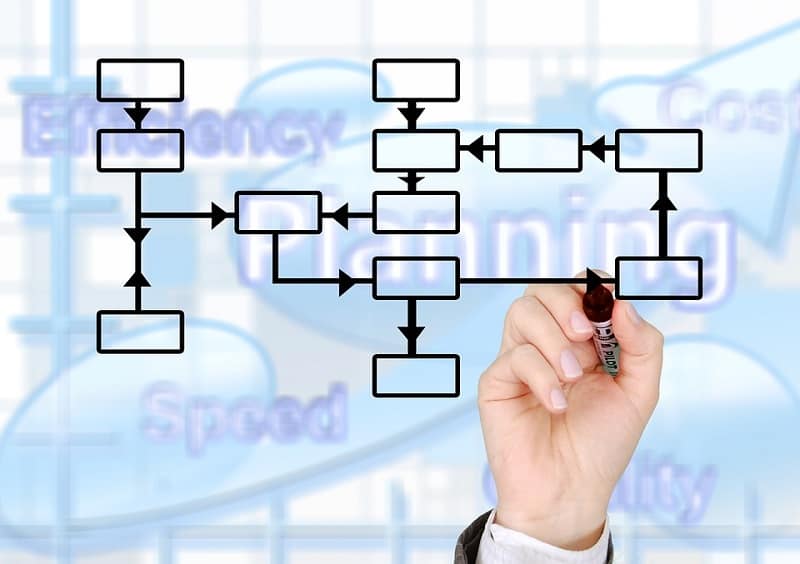

Managing personal loans as a small business owner requires strategic planning and discipline. It is essential to understand the impact of these loans on your overall financial health. By employing smart finance techniques, you can stay on top of your payments and avoid potential pitfalls.

Table of Contents

Evaluate your financial condition

One of the first steps in managing personal loans effectively is to evaluate your current financial condition. This involves reviewing all your income sources, monthly expenses and existing debts. Knowing where you stand financially helps you create a realistic budget and set achievable financial goals for starting a debt resolution process which is one of the most important steps. If you don’t set realistic goals and properly evaluate exactly what is actually possible you will find it much more difficult to complete debt resolution. Keeping track of all financial aspects ensures that you are well-prepared to handle loan repayments without jeopardizing your business operations.

Additionally, conducting a thorough financial assessment allows you to identify potential areas of growth and improvement in your business. By analyzing your cash flow patterns, you can pinpoint seasons or periods when your business generates more revenue, enabling you to align your loan repayment schedule accordingly. This proactive approach not only helps in managing your personal loans but also contributes to the overall financial health of your business. Remember, a clear understanding of your financial situation empowers you to make informed decisions about taking on new debt or restructuring existing loans to better suit your business needs.

Develop a comprehensive budget

A well-structured budget is crucial for managing personal loans. Begin by listing all your monthly income sources and expenses, including loan repayments. Ensure that you allocate funds for emergency savings and unexpected expenses to avoid falling behind on payments. Sticking to a strict budget will help you maintain financial stability and prevent accumulating more debt. Moreover, it allows you to identify areas where you can cut costs and redirect funds for loan repayment.

Investigate loan consolidation options

If you have multiple personal loans, consolidating them into a single loan may be beneficial. Loan consolidation simplifies your repayment process by combining multiple debts into one manageable payment. This can potentially reduce your interest rates and monthly payments, making it easier to stay on top of your finances. Additionally, consolidating loans can improve your credit score by reducing the number of open accounts and lowering your debt-to-income ratio.

Seek expert advice

If managing personal loans becomes overwhelming, consider seeking expert advice from a financial advisor or credit counselor. These professionals can provide personalized strategies tailored to your unique financial situation. They can help you understand the implications of different loan options and develop a plan to pay off your debts efficiently. Professional guidance ensures that you make informed decisions and avoid common financial mistakes that could harm your business in the long run.